In its latest financial disclosure, Penn Entertainment reported a solid $1.4 billion in Q1 revenue, marking a notable rebound from a previous loss. Despite falling short of Wall Street’s expectations of $1.7 billion, the company’s revenues showcase a strategic shift towards growth in its interactive segment, driven by innovations such as ESPN BET and enhanced online casino performance. The results reflect a resilient approach taken by Penn, with the CEO highlighting advancements even while contending with winter weather disruptions that affected sports betting outcomes. Furthermore, their adjusted EBITDAR of $457 million signals a narrowing of net losses compared to last year. With a focus on expanding their sports betting market share, Penn is positioning itself to seize further opportunities in an increasingly competitive landscape.

Penn Entertainment has recently released its earnings report for the first quarter, revealing a revenue figure of $1.4 billion, indicating a significant recovery from prior financial setbacks. As the company navigates the challenging gaming landscape, it sees promising growth in its digital operations, with noted increases tied to ESPN BET and the overall online casino market. The interactive segment, a critical part of their portfolio, is generating buzz with plans for innovative features and loyalty initiatives, marking a pivotal shift in how fans engage with sports betting. While the overall earnings did not fully meet market expectations, the improvements noted in their operations suggest a proactive restructuring aimed at maximizing revenue potential. Looking forward, Penn is strategically investing in capabilities to enhance its market presence and boost profitability.

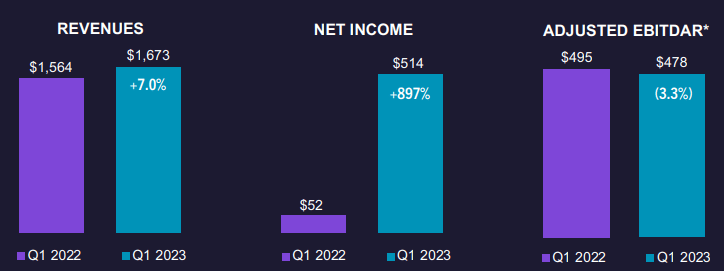

Penn Entertainment Q1 Revenue Analysis

In the first quarter, Penn Entertainment reported total revenue of $1.4 billion, indicating a notable recovery compared to the previous year’s loss. However, this revenue fell short of analysts’ forecasts, which estimated figures to reach $1.7 billion. The underperformance was attributed to adverse winter weather conditions and a slowdown in sports betting results that hampered overall fiscal performance.

The reported adjusted EBITDAR of $457 million, while significant, reflects the impact of external factors as CEO Jay Snowden noted a $10 million detriment from weather issues. This complexity underscores the volatile nature of the gaming sector, linking broader environmental factors to financial output. Despite incurring a net loss of $0.25 per share, which was better than anticipated, these results indicate a challenging yet improving financial landscape for the company.

Interactive Segment Revenue and Growth

Penn Entertainment’s interactive segment, which includes its digital sports betting and online casino operations, generated an impressive $290.1 million in revenue. They noted that despite reporting an adjusted EBITDA loss of $89 million, this figure shows considerable improvement from the previous year’s losses. The underlying dynamics suggest that as online operations evolve, they are starting to yield better returns.

The growth in this segment is crucial to Penn’s strategy, particularly as they leverage the ESPN BET platform to build out its online casino offerings. With new user acquisitions and ongoing investments in technology, the interactive segment illustrates a considerable potential for profitability moving forward. As CEO Snowden indicated, there are positive signs of maturation in their digital operations, which could lead to improved financial performance as market conditions stabilize.

ESPN BET’s Role in Future Growth

Amidst a competitive landscape, ESPN BET has emerged as a vital growth engine for Penn Entertainment. Although it ranks at a modest 2.7% market share nationally as of March, the platform’s development signals strong potential to amplify Penn’s standing in the online sports betting domain. This improvement is crucial as the company aims for a 20% market share in sports betting by 2027.

The addition of features tailored for users, such as personalized betting options and integration with fantasy sports, could significantly elevate user engagement. Such developments may also augment ESPN BET’s competitive edge, translating into higher revenues. Given the current trajectory, the growth of ESPN BET could be fundamental to achieving Penn’s long-term market strategies.

Market Conditions Impacting Sports Betting

Market conditions play a significant role in Penn Entertainment’s strategy and financial outcomes. Significant weather disruptions in the first quarter affected not only foot traffic to physical locations but also online engagement with betting platforms. This dual impact may have exposed vulnerabilities in the company’s reliance on certain seasonal trends.

As Penn contemplates expanding its market share within the sports betting arena, it must navigate these market conditions with agility. Proactive measures like diversifying offerings and optimizing user experiences can help mitigate the effects of unforeseen events, ensuring the company remains resilient against market shifts.

Online Casino Performance Metrics

The performance of Penn Entertainment’s online casino segment has been one of the brighter spots in their financial portfolio. The interactive segment’s contributions, detailed with $290.1 million in revenue, highlight the potential of online gaming as a stable income source. This segment draws significant user engagement, driven by innovative products and features enhancing user experience.

Moreover, Penn’s ongoing commitment to digital transformation in its online casino operations suggests a keen awareness of shifting player preferences. By leveraging technology and integrated digital strategies, the company can achieve more substantial performance metrics in the online space, potentially improving overall profitability.

Future Projections and Strategic Goals

Looking forward, Penn Entertainment anticipates digital revenue for the second quarter to range between $280 million to $320 million, highlighting a cautiously optimistic outlook. The estimations reflect a gradual recovery plan as the company adapts to current market dynamics and aims for profitability in its digital ventures by Q4.

With strategic investments and an eye on expanding market share, Penn remains committed to its long-term objectives. Their calculated approach, focusing on operational efficiencies, technological enhancements, and a diversified offering, could foster sustained growth and stability, particularly in the throes of market fluctuations.

Share Repurchase Strategies and Market Position

In maintaining a robust market position, Penn Entertainment’s share repurchase strategy, involving $35 million repurchased through early May, reflects a commitment to enhancing shareholder value. The company aims to repurchase a total of at least $350 million worth of shares by 2025, reaffirming confidence in its long-term strategy amidst ongoing market challenges.

This repurchase initiative not only indicates a strong operational cash flow but also serves as a strategic maneuver to enhance share value for existing investors. By proactively managing its equity, Penn signals intimacy with investor sentiments while focusing on sustainable growth avenues in a competitive gaming environment.

Addressing Governance Concerns Amidst Financial Growth

As Penn Entertainment navigates its financial growth trajectory and ambitious market goals, it faces scrutiny surrounding its governance structure. Recent tensions with hedge fund HG Vora Capital and ongoing disputes over board representation highlight the complexities of balancing shareholder interests with operational strategies.

Maintaining transparency and responsiveness in governance will be essential for Penn as it attempts to build shareholder trust while executing its growth agenda. Addressing these challenges proactively may prove crucial in securing a favorable environment for long-term strategic objectives within the increasingly competitive gaming landscape.

Innovative Features and User Engagement Strategies

In a bid to enhance user engagement, Penn Entertainment continues to innovate its sports betting platforms, particularly through ESPN BET. The introduction of unique functionalities, such as fantasy-integrated betting options, can substantially increase user interaction and retention, enticing bettors to leverage the platform more frequently.

Moreover, harnessing insights from user data to tailor offerings and incentives could prove astonishingly effective in boosting user volumes. As highlighted by CTO Aaron LaBerge, initiatives like the Mint Club loyalty program reflect a strategic gamble aimed at nurturing deeper customer loyalty and fostering a thriving betting community.

Conclusion: A Promising Outlook for Penn Entertainment

Despite the setbacks experienced in Q1 2023, Penn Entertainment is poised for a rebound as it adapts to evolving market conditions. The substantial revenue in its interactive segment, coupled with innovative strategies, showcases the company’s commitment to growth and financial stability.

As they work towards optimizing their operations and enhancing the user experience in digital channels, Penn’s roadmap appears promising. With clear goals and a strategic focus on integrating technology and improving overall market share, the company sets its sights on a hopeful future in the competitive gaming landscape.

Frequently Asked Questions

What did Penn Entertainment report for Q1 revenue and how does it compare to expectations?

Penn Entertainment reported Q1 revenue of $1.4 billion, which was below Wall Street’s expectations of $1.7 billion. Factors contributing to this shortfall included winter weather disruptions and underperforming sports betting results.

How did ESPN BET growth impact Penn Entertainment’s interactive segment revenue in Q1?

The ESPN BET growth contributed significantly to Penn Entertainment’s interactive segment revenue, which totaled $290.1 million in Q1. This reflects strong year-over-year growth in the digital sports betting realm, despite ongoing challenges.

What was the performance of Penn Entertainment’s online casino operations in the first quarter?

Penn Entertainment’s online casino performance was enhanced by the ESPN BET platform during Q1, contributing to the overall interactive segment revenue. The company noted improvements in its digital operations, offsetting some challenges faced in sports betting.

How has Penn Entertainment’s sports betting market share evolved, particularly with ESPN BET?

In March, ESPN BET accounted for a modest 2.7% market share, ranking sixth nationally. Penn aims to reach a 20% sports betting market share by 2027, with ESPN BET seen as a pivotal growth driver for its online operations.

What factors influenced Penn Entertainment’s adjusted EBITDAR and net loss in Q1?

The company reported an adjusted EBITDAR of $457 million, influenced by weather events that negatively impacted performance by at least $10 million. Penn’s net loss was narrowed to $0.25 per share, better than the expected $0.29 loss.

What are the key strategies Penn Entertainment is using to boost its digital operations?

Penn Entertainment is focusing on enhancing its digital operations through innovations in its ESPN BET platform, launching new rewards programs like Mint Club, and exploring integration with Disney’s ESPN streaming service.

How is Penn Entertainment addressing its shareholder concerns amid ongoing proxy battles?

While discussing Q1 revenue, Penn Entertainment did not directly address its proxy battle with HG Vora Capital but emphasized its commitment to share repurchases and strategic goals, amidst tensions regarding corporate governance.

What future revenue projections did Penn Entertainment provide for its digital segment?

Penn Entertainment projected its second-quarter digital revenue to be between $280 million and $320 million, with plans to achieve profitability in the digital segment by Q4.

| Key Metrics/Information | Details |

|---|---|

| Q1 Revenue | $1.4 billion, below Wall Street’s expectation of $1.7 billion. |

| Adjusted EBITDAR | $457 million, showing improvement compared to last year’s $0.79 loss per share, this quarter’s loss was $0.25 per share. |

| Interactive Segment Revenue | $290.1 million, despite an adjusted EBITDA loss of $89 million. |

| ESPN BET Market Share | 2.7% market share in March, ranking sixth nationally. |

| Mint Club Launch | New rewards program resulting in 2.7 times more frequent logins and 60% higher betting volume. |

| Share Repurchases | $35 million repurchased to date, with a goal of $350 million worth of shares in 2025. |

| Upcoming Digital Revenue Projections | Projected $280 million to $320 million for Q2, aiming for profitability by Q4. |

Summary

Penn Entertainment Q1 revenue reflects a notable recovery with $1.4 billion posted this quarter, despite falling short of analysts’ expectations. The firm has shown resilience with improvements in its interactive segment, alongside plans to increase its digital market share significantly. Although facing challenges from weather disruptions and competition in sports betting, the introduction of new programs like Mint Club is expected to strengthen user engagement and increase bets. Looking forward, Penn’s commitment to reaching a 20% market share in sports betting by 2027 highlights its ambitious strategy. Overall, while the current quarter revealed mixed results, Penn Entertainment is navigating its growth trajectory in the evolving gaming landscape.